The 25-Second Trick For Frost PllcTable of ContentsFrost Pllc Can Be Fun For EveryoneFrost Pllc - The Facts5 Simple Techniques For Frost PllcNot known Factual Statements About Frost Pllc Frost Pllc Things To Know Before You BuyBear in mind that Certified public accountants and auditing companies deal with their clients to enhance economic technique

How Guided Wealth Management can Save You Time, Stress, and Money.

The smart Trick of Guided Wealth Management That Nobody is DiscussingTable of ContentsGuided Wealth Management - The FactsGetting My Guided Wealth Management To WorkHow Guided Wealth Management can Save You Time, Stress, and Money.Not known Incorrect Statements About Guided Wealth Management Getting The Guided Wealth Management To WorkFor more sugg

Top Debt Consultant Services Singapore: Secure Your Financial Future

Unlock the Conveniences of Engaging Debt Specialist Services to Navigate Your Course Towards Debt Relief and Financial FlexibilityInvolving the solutions of a financial obligation consultant can be an essential action in your trip towards achieving financial debt alleviation and financial stability. The inquiry remains: what certain advantages can

Cost of Retirement in Singapore: Computing the Necessary Quantity

The Importance of Early Preparation for Retirement in Singapore: Ensuring Financial Stability and Lifestyle in Your Golden YearsIn Singapore, where the landscape of living costs proceeds to increase, the significance of very early retired life preparation can not be overemphasized. As individuals navigate their jobs, the requirement for a robust mo

How Debt Management Plan Services Can Help You Achieve Financial Security

Opening the Perks of a Tailored Financial Obligation Administration Plan Created by ProfessionalsIn the world of monetary management, the intricacies surrounding financial debt can often present difficulties that need a nuanced strategy. By delegating the layout and implementation of a tailored financial obligation administration plan to experts in

Judd Nelson Then & Now!

Judd Nelson Then & Now! Destiny’s Child Then & Now!

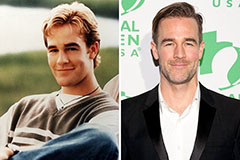

Destiny’s Child Then & Now! James Van Der Beek Then & Now!

James Van Der Beek Then & Now! Bernadette Peters Then & Now!

Bernadette Peters Then & Now! Peter Billingsley Then & Now!

Peter Billingsley Then & Now!